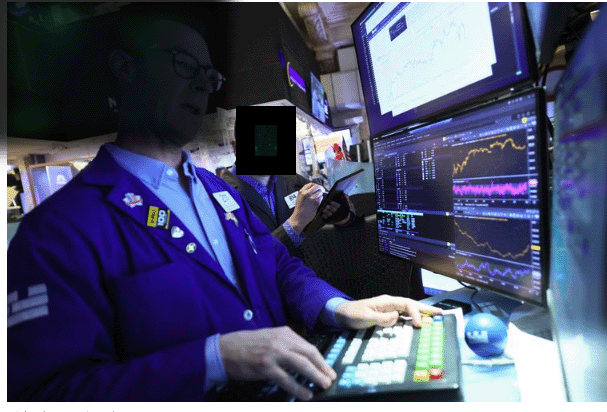

Stocks Surge as Trump Calms China Tensions and Powell Concerns Fade

Wall Street is rallying for a second straight day, with the Dow, S&P 500, and Nasdaq all making impressive gains as investor anxiety over trade and interest rates begins to ease.

The Dow Jones Industrial Average soared 975 points, or 2.5%, to reach 40,165.25. Earlier in the session, it had been up more than 1,100 points before paring back slightly. The S&P 500 jumped 3% to 5,450.23, while the tech-heavy Nasdaq surged 4.1% to 16,960.60.

- Tezlyn Figaro just did what few can: she left “Mr. Wonderful” Kevin O’Leary completely speechless. 💥

- General Horta Nta Na Man Sworn In as Transitional Leader After Guinea-Bissau Coup

- Nvidia’s Next Surge? Why the AI Giant May Be Nowhere Near Its Peak

- How to Qualify for AIV’s $2.23 Special Dividend — Even After the Record Date

- Bitcoin Price Drop Explained: Whale Sell-Offs, ETF Outflows & Why ETH, SOL Outperformed

- Why Are Crypto & Stocks Falling While Gold Rises? 3 Key Reasons Behind the Market Sell-Off

All three major indexes are on pace to post back-to-back gains of more than 2%—a rare feat not seen since 2022. For the Nasdaq, it could mark the first time it’s posted consecutive daily gains of 2.5% or more since May 2022.

But it’s not just equities enjoying the upswing. The U.S. Dollar Index has also surged, rising 0.7% to 99.58 on the day and up 1.3% over the past two sessions. That marks its strongest two-day rally since December 2023, according to Dow Jones Market Data.

What’s driving the optimism? Markets are reacting positively to President Trump’s recent efforts to cool tensions with China, signaling a softer stance on trade and easing fears of a prolonged economic standoff. At the same time, concerns over potential rate hikes from Federal Reserve Chair Jerome Powell have started to fade, encouraging investors to adopt a more risk-on approach.

Despite the rally, the indexes still have some ground to cover before officially exiting correction—or in the Nasdaq’s case, bear market—territory. The Dow would need to climb to 41,410.15 to confirm a 10% recovery from its recent low. The S&P 500 needs to reach 5,481.05, and the Nasdaq would have to hit 18,321.50 to mark a 20% gain and exit its bear market status.

Still, today’s momentum has brought renewed energy to the markets, as investors grow more confident that recent headwinds may be starting to shift.

come and join me at moomoo!Sign up via my referral link now and claim 8.1% APY and up to 15 free stocks!

account when you invite 3 or more friends to sign