RDDT Stock: Decoding Drivers Ahead of Russell 3000 Inclusion

Reddit’s stock (NYSE: RDDT) is poised for a significant shift as it prepares to join the Russell 3000 Index by the end of June 2025. This inclusion is set to alter its trading dynamics and investor profile. As the market scrutinizes its performance, valuation, and future, understanding the core influences on Reddit’s stock price is crucial for traders and investors

The Russell 3000 Index, a benchmark for over $10 trillion in global assets, tracks the 3,000 largest U.S. companies. Reddit’s addition, effective after the market close on June 27, 2025, will automatically lead to its shares being acquired by numerous passive ETFs and mutual funds. This move is anticipated to:

- Boost liquidity: Mandatory purchases by index funds will increase trading volumes.

- Attract new capital: Index inclusion often correlates with a 15–20% valuation premium.

- Enhance visibility: Membership in a major index elevates Reddit’s standing among institutional and retail investors.

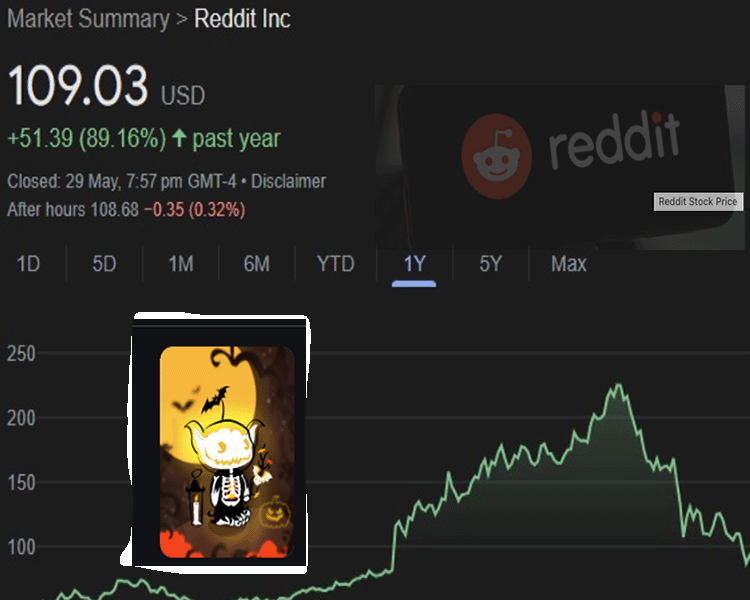

Reddit’s stock has experienced considerable volatility post-IPO, peaking at $230.41 before settling near $111–$113 by late May 2025. While up 87% over the past year, it has declined 33% year-to-date, reflecting both strong initial interest and subsequent market adjustments.

Key Drivers Influencing Reddit’s Stock Price

- Earnings Momentum and Revenue Growth Reddit’s Q1 2025 results demonstrated strong performance:

- Revenue: $392.4 million, a 61% year-over-year increase.

- EPS: $0.13, a significant improvement from an $8.19 loss per share last year.

- User Growth: Daily active users climbed 31% to 108.1 million, with international markets showing robust expansion. Robust revenue growth and improving profitability have fueled positive sentiment, despite a moderation in user growth rates compared to prior quarters.

- Valuation and Market Sentiment Trading at approximately 178 times forward earnings and nearly 15 times sales, Reddit’s valuation reflects high expectations for future growth. However, this also makes the stock susceptible to sharp corrections if results fall short. Current market sentiment is “neutral,” with a Fear & Greed Index at 39 (Fear). Analysts hold a “Moderate Buy” consensus, with price targets ranging from $115 to $165.

- AI and Search Disruption Risks A primary concern for Reddit is the evolving search landscape. The rise of Google’s AI-powered search could potentially reduce direct traffic to Reddit, impacting its advertising-driven business model. Over half of Reddit’s traffic originates from logged-out users, often via Google. If AI directly answers user queries, Reddit could see reduced engagement and ad revenue.

- Monetization and New Features Reddit is actively diversifying its revenue streams through:

- Advertising: Ad revenue surged 61% year-over-year in Q1.

- AI tools: Features like Reddit Answers aim to boost engagement and monetization.

- Premium offerings: Expanding paid features and direct purchase ads are expected to support future growth.

- Index Inclusion Effects Historically, stocks added to major indexes often experience:

- Short-term price bumps: Driven by index fund purchases.

- Increased trading volume: Leading to greater liquidity.

- Longer-term re-rating: Potential for a sustained higher valuation if fundamental growth continues. However, these effects can be temporary if the company’s fundamentals do not align with market expectations.

What to Watch

- Q2 and Q3 Earnings: Monitor Reddit’s ability to sustain revenue and user growth.

- AI and Search Trends: Observe how shifts in Google and other platforms impact Reddit’s visibility and ad revenue.

- Index Rebalancing: Anticipate higher trading volumes and potential price volatility around the June 27 inclusion date.

- Valuation Risks: High multiples mean the stock is sensitive to news and performance.

Conclusion

Reddit’s impending Russell 3000 Index inclusion is a significant catalyst, promising increased liquidity, visibility, and institutional interest. However, investors should carefully weigh the company’s strong revenue growth and user base against potential risks from AI-driven search disruption and its elevated valuation. As the inclusion date approaches, close attention to earnings, market sentiment, and trading volumes will be key to navigating Reddit’s stock trajectory.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

come and join me at moomoo!Sign up via my referral link now and claim 8.1% APY and up to 15 free stocks!

account when you invite 3 or more friends to sign