Bitcoin Surges to Record Near $110K Amid Wall Street Adoption and Political Support

Bitcoin soared to an all-time high of nearly $110,000 on Wednesday, fueled by a wave of institutional investment, political endorsement, and increasing mainstream legitimacy. The digital currency briefly reached $109,900 before retreating slightly to around $108,000 as U.S. stocks dipped, highlighting how crypto markets remain closely tied to broader financial trends.

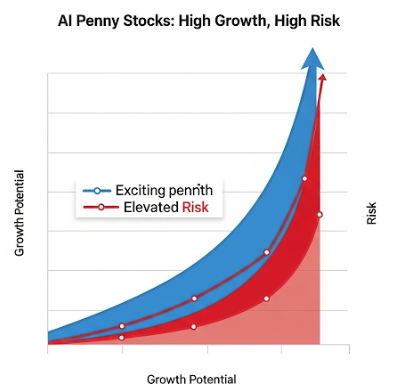

Best AI Penny Stocks: High-Risk, High-Reward Investment Opportunities

Justin Bieber Denies Diddy Victim Status, Advocates for Survivors Amid Trial

Bitcoin’s Rally: What’s Driving the Price Surge in 2025?

China Blacklists Hong Kong Tycoon Li Ka-shing Over Panama Canal Ports Sale to US Firm

This historic rally comes as both Wall Street and Washington signal a strong shift toward embracing digital assets. What was once considered a fringe financial experiment is now being rapidly integrated into the core of global finance.

On Capitol Hill, momentum has been building around cryptocurrency regulation. Earlier this week, the Senate voted to advance legislation aimed at establishing a regulatory framework for stablecoins—marking what could soon become the first major piece of crypto-related legislation passed by Congress. Additionally, President Donald Trump, who had previously shown skepticism toward digital currencies, recently directed the U.S. Treasury to establish a Strategic Bitcoin Reserve. This move, aimed at strengthening the country’s digital financial infrastructure, is seen as a symbolic and practical endorsement of Bitcoin’s long-term role in the global economy.

Support from Washington has only accelerated adoption on Wall Street. JPMorgan Chase, led by longtime crypto skeptic Jamie Dimon, announced on Monday that it will begin offering bitcoin investment options to its clients. This marks a significant reversal and adds to the growing list of major financial institutions embracing crypto. BlackRock, Morgan Stanley, and Fidelity have all expanded their digital asset offerings, with BlackRock’s iShares Bitcoin Trust (IBIT) emerging as a standout.

IBIT has attracted an estimated $6.5 billion in inflows over the last month, pushing it from the 47th to the 5th highest-ranking U.S. ETF in terms of year-to-date inflows, according to Bloomberg ETF analyst Eric Balchunas. The surge reflects investor optimism and a broader move into risk-on assets amid easing global trade tensions.

Meanwhile, corporate adoption continues to play a major role in Bitcoin’s rise. MicroStrategy, the business intelligence firm known for pioneering corporate Bitcoin treasury strategies, added another $765 million worth of BTC last week. The company’s total Bitcoin holdings now exceed $63 billion. Inspired by its model, other companies are following suit. Just last month, a SPAC (special purpose acquisition company) led by Brandon Lutnick—the son of President Trump’s commerce secretary—announced plans to launch “Twenty One,” a competitor to MicroStrategy’s Bitcoin strategy.

This convergence of institutional capital, regulatory clarity, and political backing represents a new chapter for Bitcoin. Rather than a speculative asset on the financial periphery, Bitcoin is increasingly being treated as a core component of long-term investment portfolios and national financial strategies.

As crypto becomes further intertwined with traditional finance and federal policy, the recent surge in Bitcoin’s price may be less a flash-in-the-pan rally—and more a reflection of a paradigm shift in how global markets perceive and utilize digital assets.

come and join me at moomoo!Sign up via my referral link now and claim 8.1% APY and up to 15 free stocks!

account when you invite 3 or more friends to sign