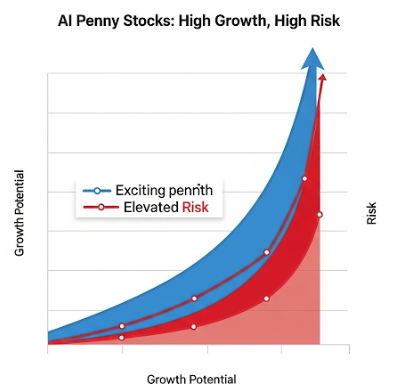

Best AI Penny Stocks: High-Risk, High-Reward Investment Opportunities

investing in “AI stocks under $5” is a high-risk, high-reward strategy often associated with “penny stocks.” These stocks can be highly volatile and are not suitable for all investors. While they offer the potential for significant gains, they also carry a much higher risk of substantial losses compared to more established companies.

Many of the prominent AI companies (like Microsoft, Amazon, Google, Nvidia, Palantir, etc.) have stock prices far exceeding $5 per share. When looking for AI stocks under $5, you are generally looking at smaller companies, often with less established revenue streams, smaller market caps, and sometimes unproven business models.Here are some AI-related companies that have recently been mentioned with stock prices under or around $5, along with considerations for investing in them:

Stocks Surge as Trump Calms China Tensions and Powell Concerns Fade

No More Excuses: Lessons from China’s Scale and Singapore’s Scarcity

Bernie Sanders: A Trojan Horse for the Establishment

Nancy Pelosi’s Latest Stock Moves – Tempus AI & Big Tech Bets

Companies Mentioned with Stock Under or Around $5 (as of recent searches

Important Considerations for “Penny AI Stocks

Biotricity Inc. (BTCY): Focuses on medical diagnostic and consumer healthcare technology, particularly biometric data monitoring. Its stock has been around $0.59.

Rekor Systems Inc. (REKR): Offers AI-driven roadway intelligence solutions for public safety and urban mobility. Its stock has been around $1.21.

iCAD Inc. (ICAD): A software company offering AI-powered mammography analysis for breast cancer detection.

Remark Holdings, Inc. (MARK): Known for its AI-based products that provide big data analytics, particularly useful in public safety and workplace compliance. It was noted as being around the $3 mark.

Creative Realities, Inc. (CREX): Mentioned as one of the best AI stocks under $5.

MicroAlgo Inc. (MLGO): Has seen significant short-squeeze activity and is integrating quantum algorithm products.

CXApp Inc. (CXAI): Offers an AI-powered return-to-office and employee engagement platform.

Guardforce AI Co. (GFAI): A Singapore-based company focusing on AI agents for purchasing and travel solutions. It has traded below $2 per share.

POET Technologies (POET): A semiconductor company designing optoelectronic solutions for data centers and AI markets. It has traded under $5 and has strategic partnerships.

SoundHound AI Inc. (SOUN): Specializes in advanced voice-enabled AI and conversational intelligence technologies. While its price has recently been around $10, it has previously traded under $5 and is an NVIDIA investor.

Volatility: These stocks can experience rapid and unpredictable price swings.

Risk: They are generally considered high-risk investments due to factors like limited operating history, unproven business models, low liquidity, and potential for dilution through new stock offerings.

Profitability: Many of these companies may not be profitable yet, focusing on growth and market penetration.

Due Diligence: Thorough research is crucial. Look beyond the low stock price and investigate the company’s:

General Investment Advice:

Diversification: Do not put all your investment capital into penny stocks. Diversify your portfolio across different asset classes, industries, and company sizes.

Risk Tolerance: Only invest what you can afford to lose.

Long-Term vs. Short-Term: Some investors might look at penny stocks for short-term trading opportunities due to volatility, while others might identify long-term growth potential if the company’s technology gains traction.

Professional Advice: Consider consulting with a financial advisor who can assess your individual financial situation and risk tolerance before making any investment decisions.

The “best” AI stock under $5 is subjective and depends heavily on your investment goals and risk tolerance. It’s essential to conduct your own in-depth research before considering an investment in any of these companies.

come and join me at moomoo!Sign up via my referral link now and claim 8.1% APY and up to 15 free stocks!

account when you invite 3 or more friends to sign